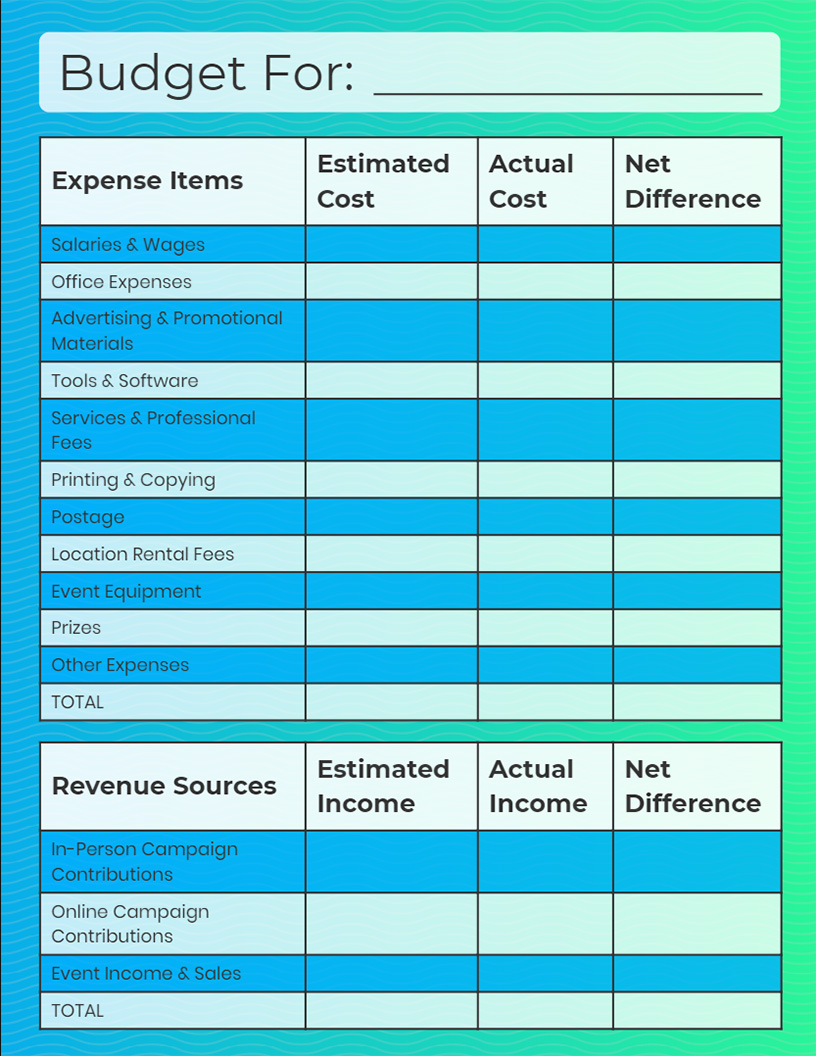

Couples Financial Planning Worksheet - Budgeting 101, it's important to stick to a budget and not overspend these days. The best way to do this is to use a printable budget worksheet that you refer to each month.

You won't be distracted by things that come with going online like social media, videos. and others

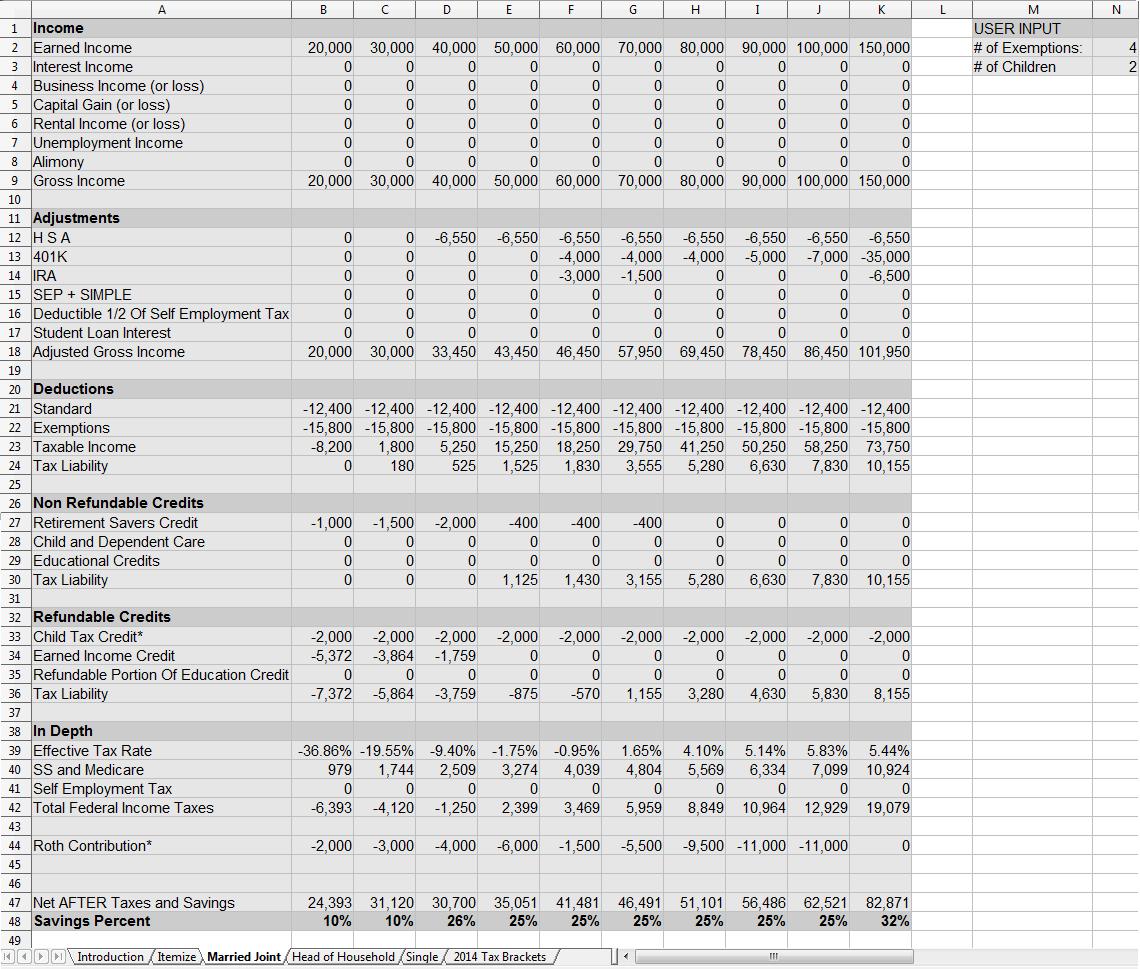

Couples Financial Planning Worksheet

In fact, if you want to stay focused, going low-tech with pen and paper is the way to go!

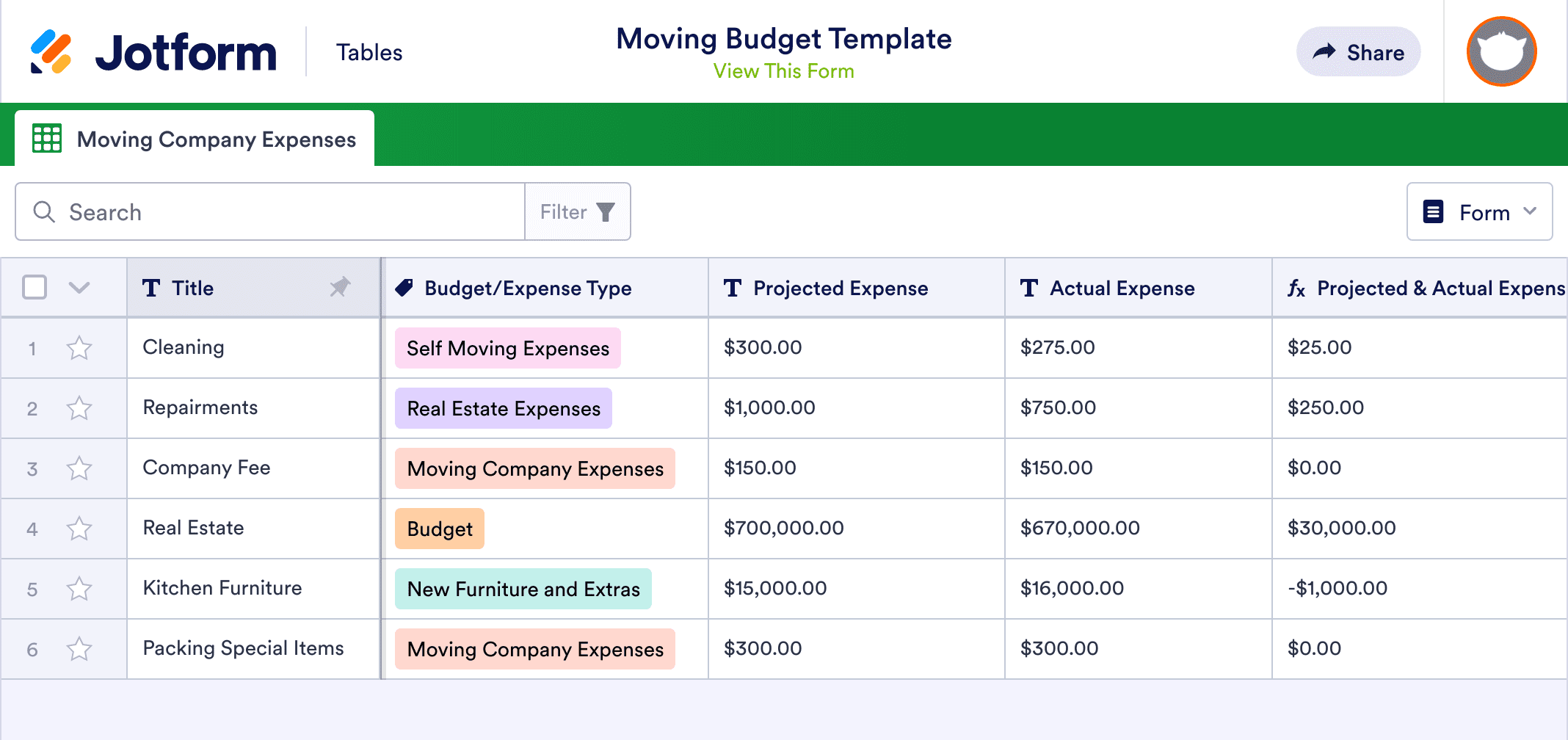

Moving Budget Template

The goal is to spend less than you make. And hopefully, you'll have some left over for savings and other financial goals.

The key is knowing your total income, your total expenses and your total debt. Recording this information on a budget worksheet gives you a good idea of where you stand financially.

Once your budget worksheet is filled out, you can refer to it from month to month to see where to make adjustments, if necessary.

Budgeting worksheets are not set in stone. Chances are, you're like most people who have had to make changes to their budgets.

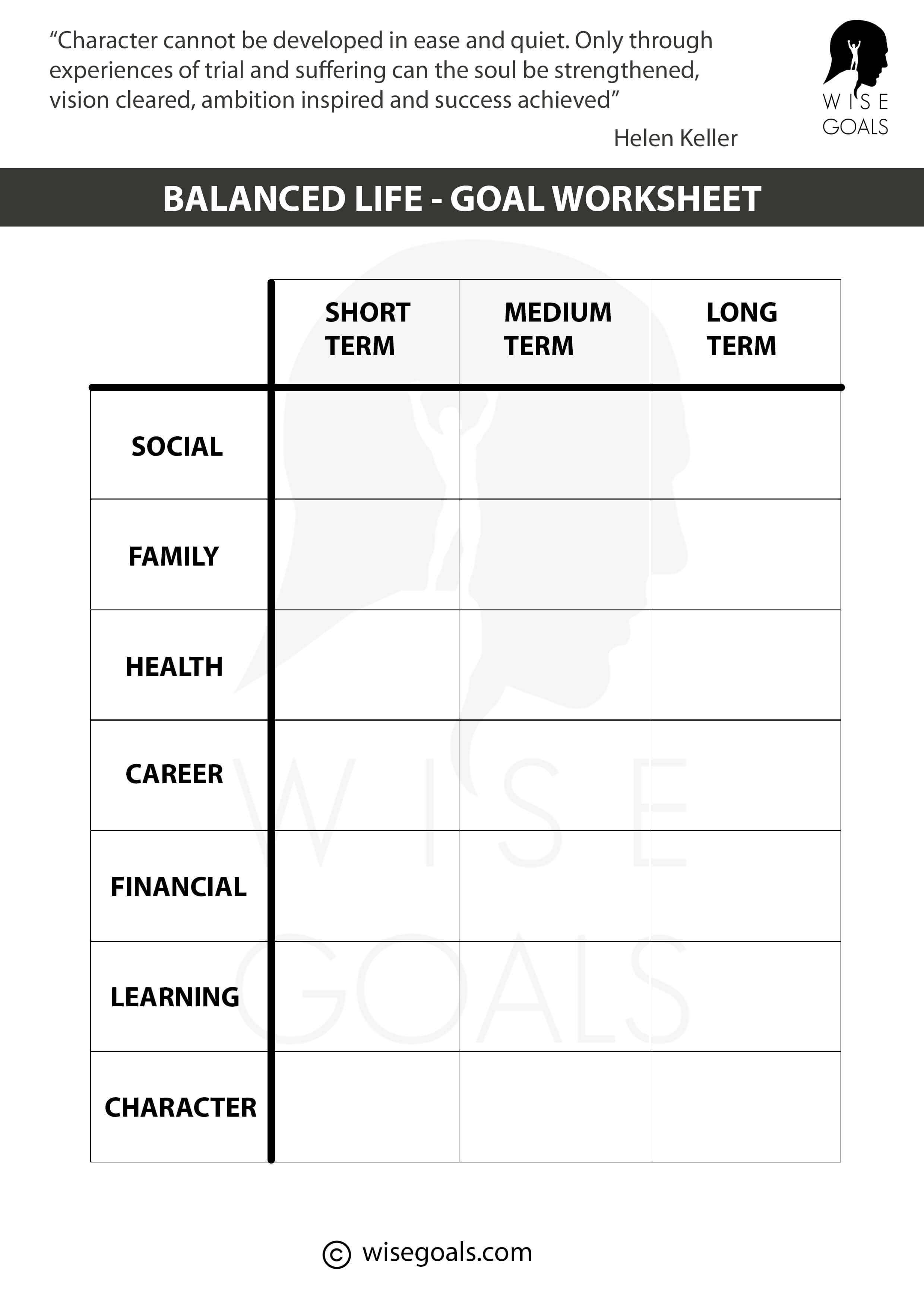

Financial Goals Worksheet To Rock Your Money

As your life changes -- you go to college, go on your own, get married, have kids, retire, so does your budget.

Let's explore the items to include in your budget worksheet, starting with income. Think of all the ways you can make money.

With salaries, everyone is paid differently. Whether weekly, bi-weekly, bi-monthly or monthly, keep this in mind when you enter your income.

In a weekly pay period, your total pay will be different for each month, so you can calculate your annual pay (after tax), and divide by 12. I know it's not perfect but do what works for you.

Top 10 Tax Planning Ideas For 2022 Chart

I know it's hard to know how much you earn when it varies from month to month. In general, you can predict your total income by looking at last year's income.

If your income increases in a few months, it is better to allocate a more conservative number. So keep it in your monthly average because you probably make at least a certain amount every month, right? Go with the number below.

Generally, pre-tax items are already deducted from your paycheck. So don't include them if your company has cut them off.

You may need to adjust your budget each month until you know how much money you should allocate to each category. Costs change from month to month so don't be afraid to make changes.

Free Simple Budget Template Printable Pdf

Film production budgets usually set aside 20% of the total contingency. It's not a bad idea to give yourself a little extra for those unexpected purchases you'll face. It doesn't have to be 20% but find out what works best for you.

For things you don't pay for every month, like car insurance, divide the total annual cost by 12. This will give you a monthly cost to add to your budget worksheet.

Want more budgeting tips? Check out my new eBook with printable budgeting worksheets, Budgeting Made Easy.

The 2023 Budget Binder That Will Change Your Finances How to Make a Budget Binder (with Prints) Free Practical Guide to Starting Your First Budget

Rule (free Excel Budgeting Template)

Hi, I'm Fanny, mother of 2, and I help busy people save money and eat more at home. I'm a little different than most frugal bloggers because I don't believe there's a one-size-fits-all approach when it comes to saving money. You are in charge of your money and you decide how to spend it. Send financial planning worksheets via email, link or fax. You can also download it, export it or print it.

It is the best editor to edit your paper online. Follow this simple guide to edit financial planning worksheets in PDF format online at no cost:

We have answers to the most popular questions from our customers. If you cannot find the answer to your question, please contact us.

5 Steps to Financial Planning Success Step 1 – Define and agree on your financial goals and objectives. ... Step 2 \u2013 Collect your financial and personal information. ... Step 3 \u2013 Analyze your financial and personal information. Step 4 \u2013 Development and presentation of the financial plan.

Retirement Planning Spreadsheet For Couples (and Individuals)

Examples of financial planning include your personal information such as age, income, tax filing status, children, etc. Review your financial goals and big picture debt relief plan (assets, debts, etc.). Investment plan (to build assets) Personal insurance. Property plan. Income tax strategy.

3:45 8:01 Manage your net worth, expenses, savings and financial goals ... YouTube Suggested start clip Suggested end So you type your goal where it says Type your goal here . And one of my goals is to save another 55,000 so you type your goal where it says type your goal here. And one of my goals is to save 55,000. Then in the required amount I will just type that amount into the cell.

8 Financial Goal Components of a Good Financial Plan ... net worth statement. ... budget planning and cash flow. ... debt management plan. ... retirement plan. ... emergency fund. ... insurance coverage. ... property plan.

Financial Planning Worksheet Excel Personal Financial Planning Worksheet Excel Financial Planning Worksheet for couples Marine Financial Planning Worksheet Personal Financial Planning Worksheet Answers

Best Free Google Sheets Budget Templates For 2023

The cycle must reach a low point where the hero almost gives up on his quest or appears defeated *resurgence*resurgence...

The personal financial planning process consists of the following six steps: Establish and define the client-advisor relationship. ... to know you. ... Analyze and evaluate the financial situation. ... develop and present financial planning proposals and/or alternatives. ... follow financial planning recommendations.

Dave Ramsey's 7 Budget Babies Step 1: Start an emergency fund. ... Step 2: Focus on the loan. ... Step 3: Complete your emergency fund. ... Step 4: Save for retirement. ... Step 5: Save for college funds. ... Step 6: Pay off your home. ... Step 7: Build Wealth.

Step-by-step instructions for creating a personal financial plan Set financial goals. It's always good to have a clear idea of why you're saving your hard earned money. ... make a budget. ... planning for taxes. ... Create an emergency fund. ... manage debt. ... protect with insurance. ... retirement plan. ... invest more than your 401(k).

Cash Envelope System {free 4 Page Printable}

There are usually six parts to a complete financial plan: sales forecast, cost estimate, statement of financial position, cash flow projection, break-even analysis and operating plan.

A good financial plan consists of seven important parts: budgeting and taxes. Managing liquidity, or ready access to cash. Financial assistance for major purchases. Manage your risk. Invest your money. Your retirement planning and wealth transfer. Communication and record keeping.

This site uses cookies to improve site navigation and personalize your experience. By using this site, you consent to our use of cookies as described in our updated privacy notice. You can change your preferences by visiting our cookies and advertising notice. Using a budget template is an easy way to start managing your money and achieving your financial goals.

It's time to stop the money pressure and take back control. All you need is a simple budget template, tracker or spreadsheet to help you track your money.

Elopement Budget Tips & Templates

So, what are the best budgeting templates, tools and apps for you to use? Let's take a closer look at our favorite picks.

Budget templates help you accurately track your monthly income and expenses—so you can easily manage your money and know where your money is going each month.

Over time your budget will show you your spending habits. This will allow you to see where you are wasting money and plan better for the future.

We've designed our free simple budget template to be as simple and easy to use as possible. You can adapt and use it for any financial situation!

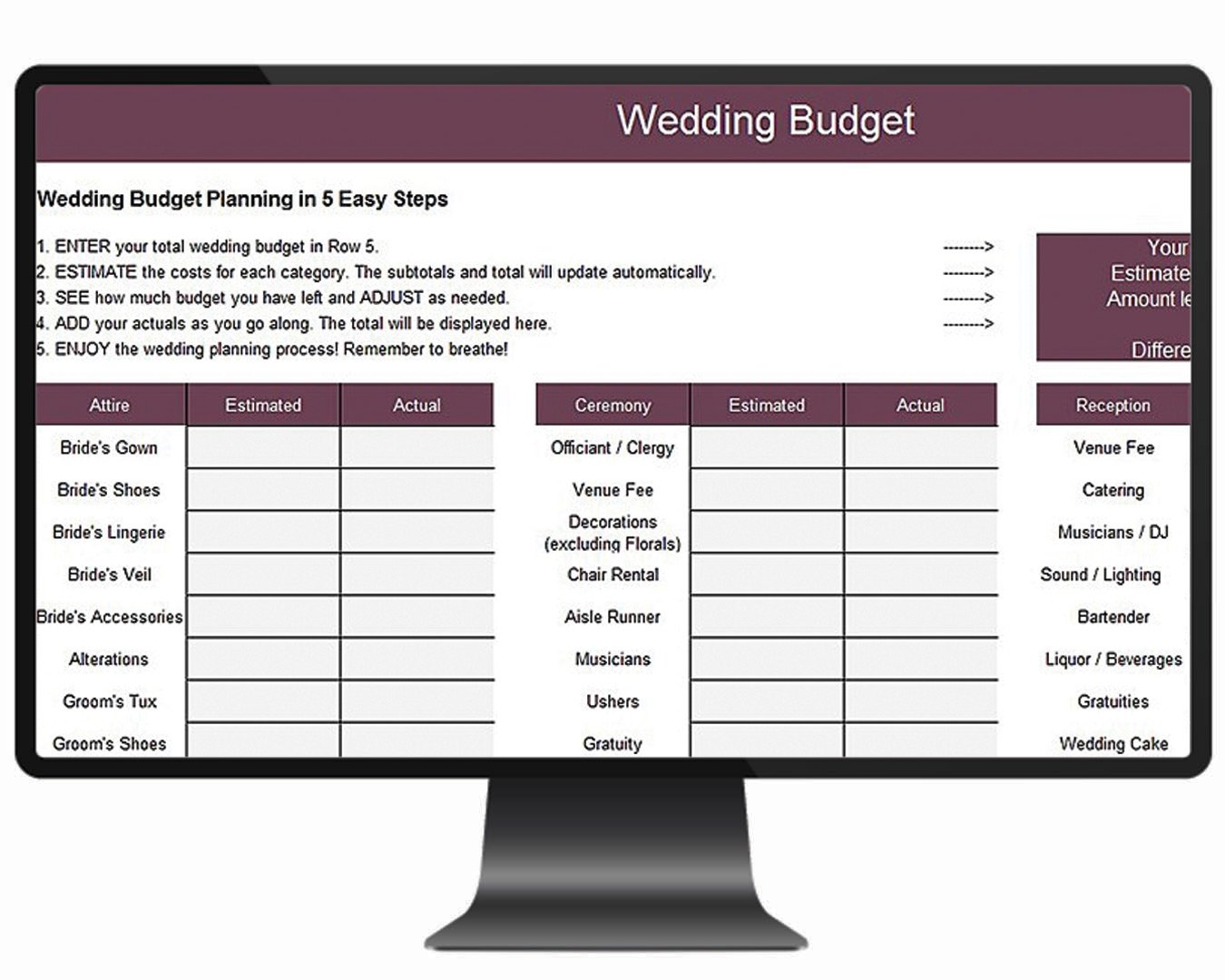

The Wedding Budget & Free Budgeting Spreadsheet

Our free templates can be printed as budget worksheets and digitally as spreadsheets that will do the math for you automatically.

We've found that when you first start out with a monthly budget, there's nothing on pen and paper, so we've created the perfect budget planner and some templates for you! We also have meal plan templates.

Add your income at the top then subtract your fixed expenses, variable expenses, debt and savings, then watch our digital budget automatically calculate your monthly cash flow at the bottom.

Google Sheets has tons of templates and budget spreadsheets to choose from, and unlike Microsoft Office, it's free with your Gmail account.

Monthly Cash Flow Worksheet For Personal Finance

If you love looking at numbers and tracking every last penny, then the Google Sheets budget spreadsheet will be perfect for you.

This type of template is perfect for people who like full control and are great with numbers. Using a budget spreadsheet is a very practical budgeting method.

Microsoft Excel has some amazing budget templates that you can use. If you have Microsoft Office, you can choose the budget spreadsheet that best suits your needs.

Microsoft has a variety of products and services, and from their templates to personal family budgets, monthly budget templates, vacation budget templates, budget calculators, and wedding budget trackers, they have a lot.

Best Budget Templates & Tools That Will Change Your Life

Personal financial planning worksheet, financial planning married couples, free financial planning worksheet, financial planning worksheet excel, retirement worksheet financial planning, newlywed financial planning worksheet, financial planning worksheet, divorce financial planning worksheet, financial planning for couples, marriage financial planning worksheet, financial goal planning worksheet, financial planning worksheet pdf

0 Comments